05 8月 Just what amortization several months is perfect for myself?

What is actually Home loan Amorization?

The borrowed funds amortization several months is how a lot of time it will take you to settle your mortgage. There is certainly a significant difference anywhere between amortization and mortgage title. The expression is the length of time that the financial agreement and you may current home loan interest rate is true having. The best home loan term from inside the Canada is 5 years, due to the fact most common amortization months is actually twenty five years.

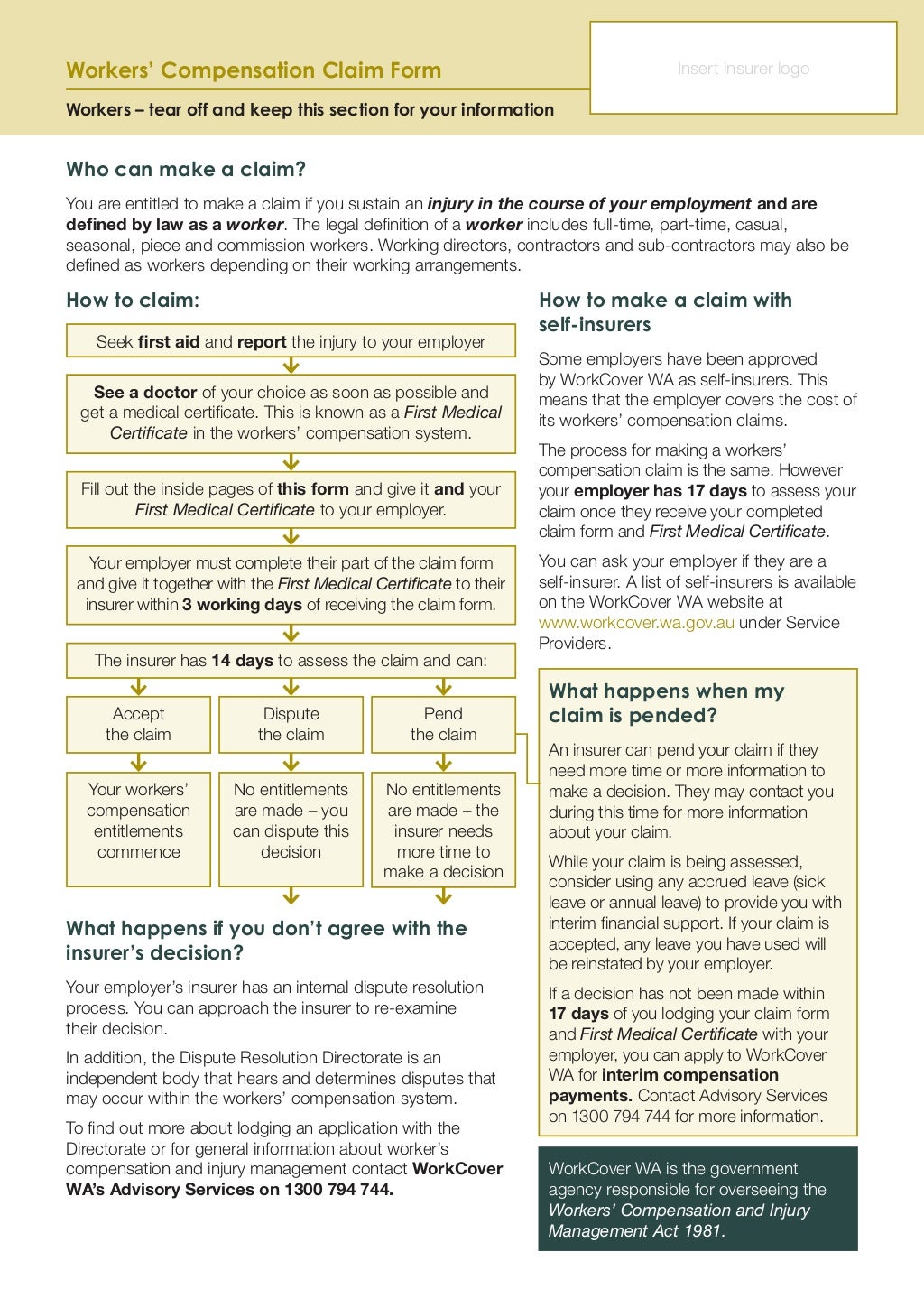

What exactly is a home loan amortization schedule?

A mortgage amortization agenda reveals the amount of each mortgage repayment, and just how most of that payment will go into the dominant while the appeal servings. Because you pay back your financial, the main that happens to your financial prominent will go up, once the appeal section will go down.

How come financial amortization functions?

The brand new amortization period will be based upon a flat level of typical and you will ongoing home loan repayments. In the event the regularity or level of the mortgage payments change, your amortization several months will additionally alter.

If you make more frequent home loan repayments, such by the changing regarding a payment so you can an expidited bi-per week payment, in that case your amortization months often fall off. This is why you are paying down your own home loan quicker whilst saving inside the attention will set you back.